530 credit score personal loans

A 600 FICO Score is below the average credit score. Along with a user friendly interface CreditSoup offers additional functionality involving a free credit score program as well as Credit Card Finder and Loan Finder.

How Bad Is A 530 Credit Score

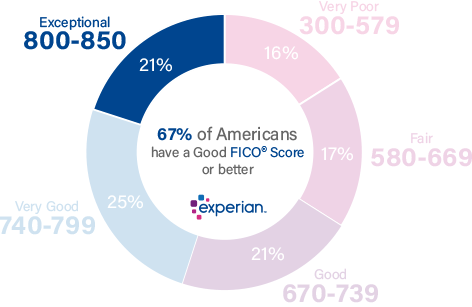

The average credit score in the United States is 710.

. Your score will drop 60 to 80 points to 600-620 on average and as low as 530. You must be 18 or older a US. The percentage of US.

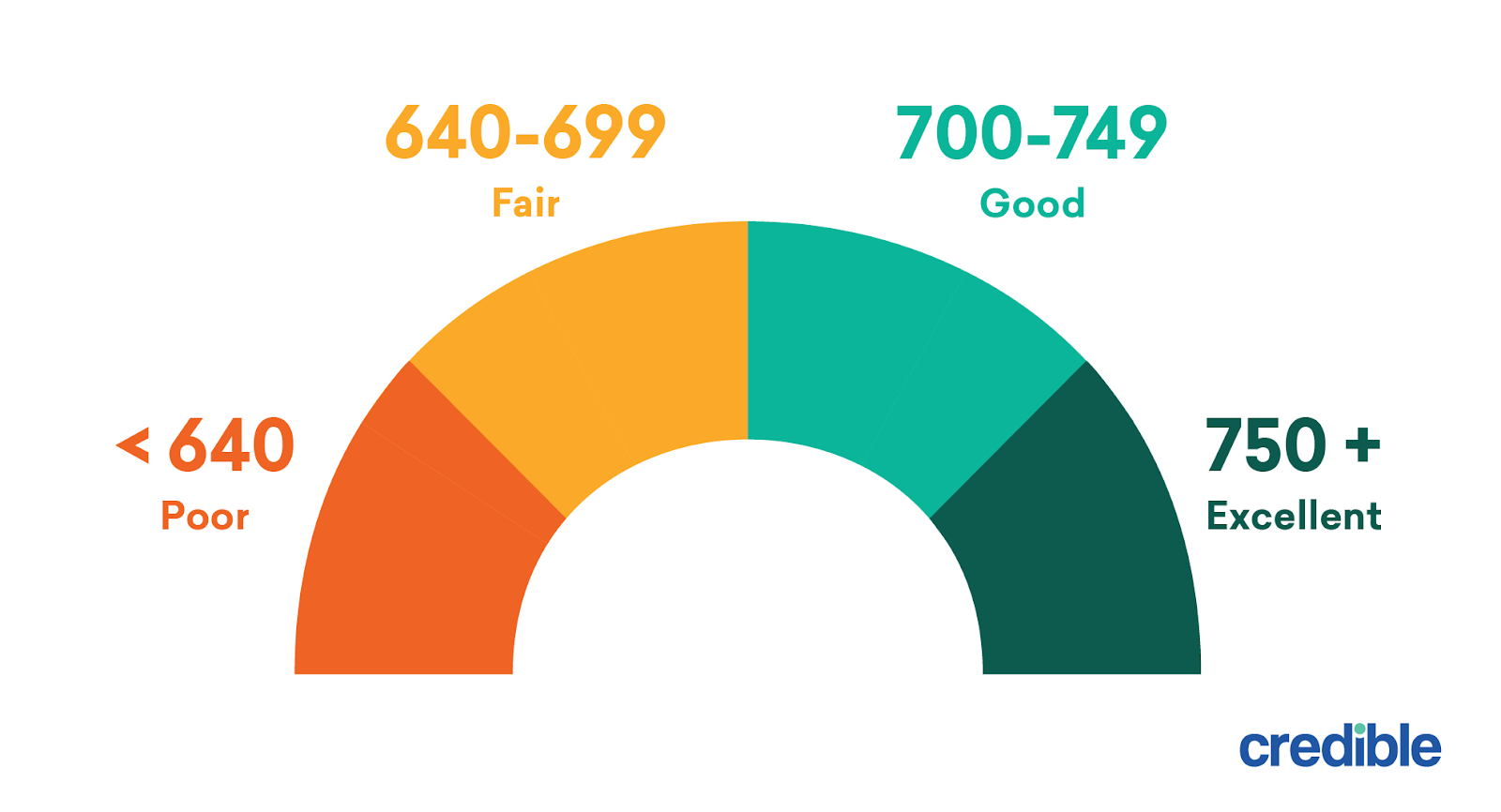

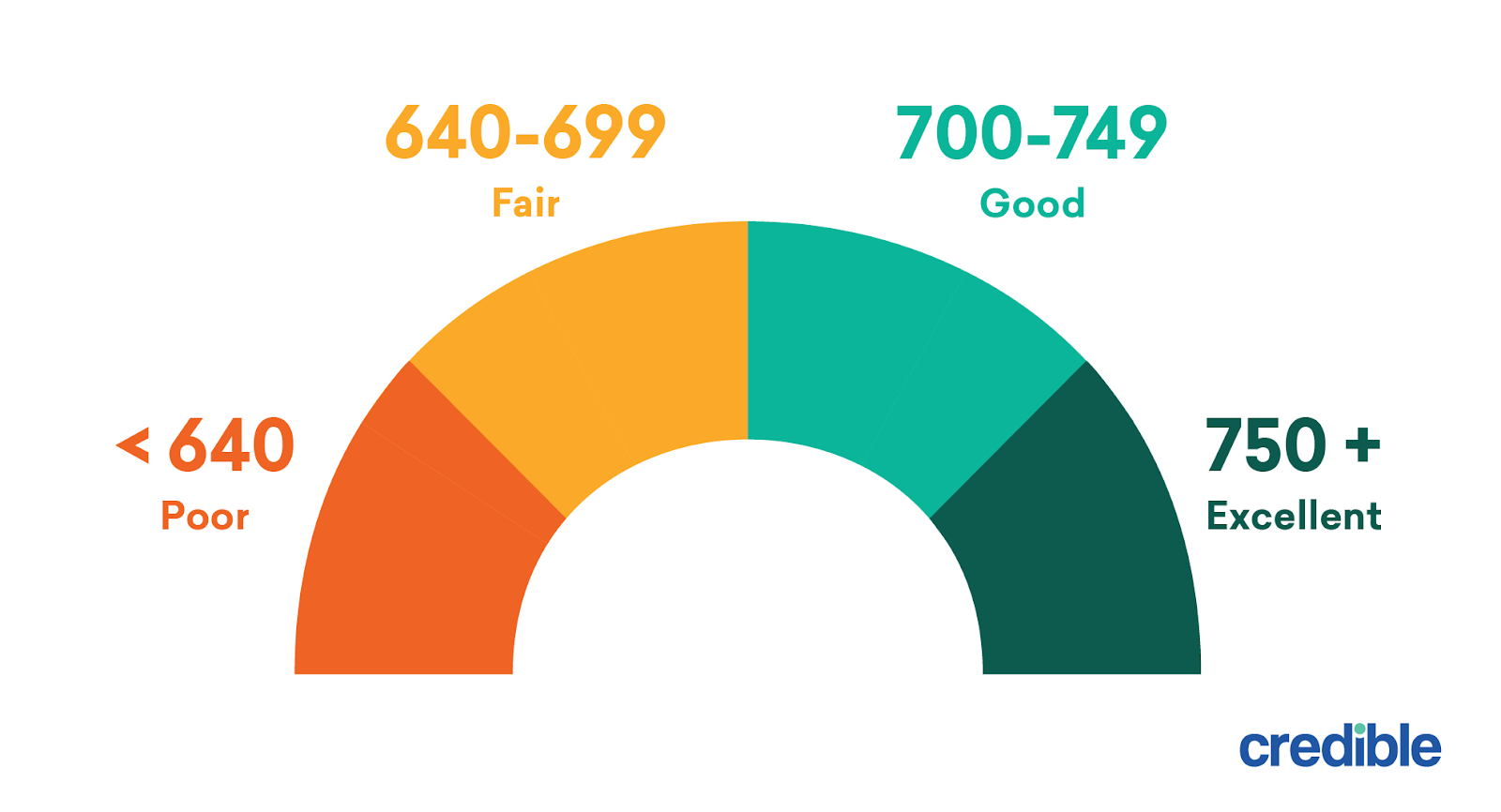

COVID-19 credit card statistics. Your score falls within the range of scores from 580 to 669 considered Fair. Personal Loans Secured Loans Bad Credit Loans Homeowner Loans Car Finance CCJ Loans.

The average credit score in America is now 710 according to Experian. With a co-applicant you could improve your offer. Having said that these loans usually have high rates shorter amortization schedules origination fees and smaller loan amounts.

Your credit score is a figure used by credit reference agencies to determine your track record of managing credit accounts and bills. It also includes personal information such as your name and address. The average credit card debt for US cardholders dropped from 6194 in 2019 to 5313 in 2020 due to the impact of the pandemic on consumer credit and spending habits.

The average new car lease term is 368 months or about three years. Back in 2019 the average credit score was 703. Though it varies across credit scoring models a score of 670 or higher is generally considered good.

Loans for Bad Credit. Checking rates will not affect your credit score. However lenders will view you as more of a risk and.

If your credit score is 720. Speak With A Representative Today866-414-4198. Our impact makes our communities and each other better.

If you have a poor credit score you may have had problems making payments in the past and have ended up with missed. For FICO a good score ranges from 670 to 739. Citizen or permanent resident and the owner of a checking account to complete the online form on the website.

Your score determines your credit rating which could be very poor poor. Credit score 523 credit score 524 credit score 525 credit score 526 credit score 527 credit score 528 credit score 529 credit score 530 credit score 531 credit score 532 credit score 533 credit score 534 credit score 535 credit score 536 credit score 537 credit. Your credit score is a number that is calculated using the information on your credit report.

VantageScore deems a score of 661 to 780 to be good. CreditSoup connects consumers to a full range of financial programs with access to credit cards for every credit type and loans for home auto consumer and debt consolidation. Some lenders see consumers with scores in the Fair range as having unfavorable credit and may decline their credit applications.

Credit reports are compiled by credit reference agencies - the three main agencies in the UK are. Credible has the most comprehensive marketplace for personal loans. A credit score that falls in the good to excellent range can be a game-changer.

Your credit report or history is a detailed record of your borrowing history with information such as the loans you have held and applied for. So whats a good credit score. If your credit score isnt good though it doesnt necessarily mean you wont get accepted for credit.

The rating is calculated using a points system based on the information in your credit report which can reveal how youve managed your debts and bills in the past. Ninety-day delinquency rates on auto loans peaked in the fourth quarter of 2010 at 53 dropping to 40 as of the fourth quarter of 2021. Your credit score is a three-digit number that indicates how reliable you are at borrowing and repaying money.

Personal loans with a 600 credit score can be easier to get than loans for credit scores under 579. Learn more about your credit score factors. APRs will range depending on your credit score and the repayment terms and structure of your loan but they will usually not exceed 36 due to federal and state regulations on these types of loans.

Consumers with an excellent credit score is 207. As you can see the better the scores before a late payment or other adverse credit event the more your scores could fall. Potentially dropping a FICO Score of 780 to between 540 and 560 while a 680 score could fall to between 530 and 550.

Up to 11 lenders compete for your business to. Personal Loans Bad Credit. Auto loan delinquency rates continue to drop from peaks.

Loan amounts can range anywhere from 1000 to 50000 and loans can be used on anything from home improvement emergency expenses vacations etc. Top credit score borrowers have the lowest average loan terms at 643 months.

530 Credit Score Good Or Bad Credit Card Loan Options

600 Credit Score Is It Good Or Bad

What Is A Good Credit Score Experian

530 Credit Score Is It Good Or Bad What Does It Mean In 2022

Personal Loans With 550 Credit Score Can I Get One Credible

Credit Card Vs Personal Loan Which One Is Reliable Elephant Journal

530 Credit Score What Does It Mean Credit Karma

What To Know About Credit When Getting A Mortgage

Personal Loans With 550 Credit Score Can I Get One Credible

3 Big Changes To Credit Scores That Will Impact Your Wallet

800 Credit Score Is It Good Or Bad

9 Best Loans Credit Cards 500 To 550 Credit Score 2022

12 Best Loans Credit Cards For 400 To 450 Credit Scores 2022 Badcredit Org

530 Credit Score Is It Good Or Bad What Does It Mean In 2022

Loans For 660 Credit Score 660 Credit Score Personal Loans Acorn Finance

Living With A 530 Credit Score Cash 1 Blog News

12 Best Loans Credit Cards For 600 To 650 Credit Scores 2022 Badcredit Org